RADIO SIGNAL

In News

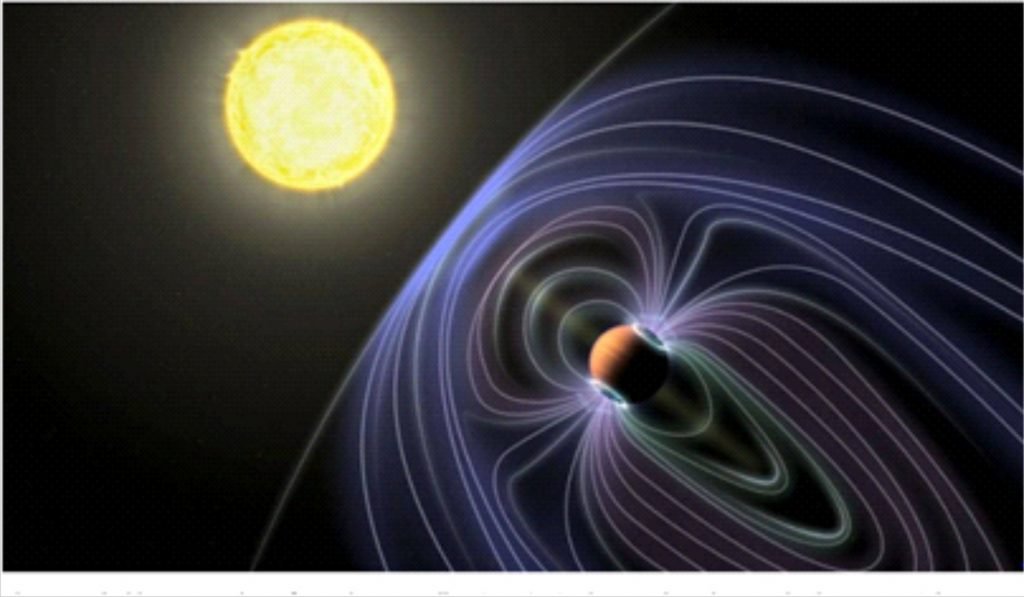

- In anextensive search for possible alien life, an international team of scientists has collected the first possible radio signal from an exoplanet system about 51 light-years away.

About

- Using the Low-Frequency Array (LOFAR), a radio telescope in the Netherlands, the researchers uncovered emission bursts from the Tau Bootes star-system hosting a so-called hot Jupiter, a gaseous giant planet that is very close to its own sun.

- Researchers also observed other potential exoplanetary radio-emission candidates in the constellation Cancer and Upsilon Andromedae systems.

- Only the Tau Bootes exoplanet system, which contains a binary star system and an exoplanet,exhibited a significant radio signature, a unique potential window on the planet’s magnetic field.

Significance

- This radio detection opens up a new window on exoplanets and provides a novel way to examine alien worlds that are tens of light-years away.

- Observing an exoplanet’s magnetic field helps astronomers decipher a planet’s interior and atmospheric properties, as well as the physics of star-planet interactions.

- The magnetic field of Earth-like exoplanets may contribute to their possible habitability by shielding their own atmospheres from solar wind and cosmic rays, and protecting the planet from atmospheric loss.

INFLATIONARY CONCERNS

In news

- India witnessed an improvement in growth as consumers spending power got expanded, especially on festival-related items, bolstered by higher-than-usual financial savings.

- The combination of mass vaccinations, herd immunity and rising recovery rates augurs well for growth but this will lead to inequality and inflation.

About

- As the world grapples with the COVID-19, India has stood out in three distinct ways:

- Over the past few weeks, India seems to have broken the link between rising levels of mobility and COVID-19 cases. The number of new cases has fallen while the fatality rate continues to drop.

- India has rolled out one of the smallest fiscal support packages globally, with central government spending flat so far this year.

- Inflation is now a big problem, with consumer prices above the 6 % tolerance level for the past eight months.

Concerns

- India is back on the path to recovery. But the low level of fiscal spending could lead to rising inequality.

- Around the world, much of the fiscal support packages have been directed towards safeguarding the poorer households and small businesses. In India, there was a focus on these areas, but the urban poor were left out, and the overall outlay was small. For instance, demand for the rural employment guarantee programme continues to outstrip supply.

- There is the rise in inequality between large and small firms as large listed firms saw a bigger rise in profits (50 per cent, year-on-year), which is likely to be felt by individual employees. A combination of cost-cutting, low interest rates, access to buoyant capital markets and increased spending in the formal economy probably helped.

- The smaller listed firms did not do as well (7 per cent, year-on-year). Unlisted informal firms, typically with small cash buffers, are likely to have faced acute economic stress.

- Large firms benefited at the cost of smaller, informal firms because spending moved from small firms to large ones as they were more efficient through the lockdown period and small firms are especially vulnerable to delays or defaults on payments they are owed, many times from the larger firms.

- Small firms are more labour intensive than large firms. The informal sector employs around 85 per cent of the labour force. If small firms do poorly, it impacts a large number of people. Data shows that small firms have cut staff costs by much more than large firms (-20 per cent year-on-year versus 0 per cent year-on-year). And limited fiscal support here could stoke inequality.

- Rising inequality could have other side effects. It could stoke inflation. India has had trouble in the past with rising prices of services. Once this trend takes hold, as it did in 2011, it remains elevated for a prolonged period.

Inflation reasons

- As a vaccine comes into play, there could be an increase in demand for high-touch services.

- As large firms and their employees do relatively well; they are likely to demand more services, inciting prices. Consumption patterns show that the rich in India tend to consume more services than the poor. Rising inequality could increase inflation.

- Many service providers did not do a regular annual price reset in 2020, so they may raise prices to cover the two years once demand picks up. If inflation does become persistent and leads to tighter monetary policy, that could weigh on growth over time.

- Putting all of this together, it seems India will come full circle in 2021. For a while it was worried more about weak growth than high inflation. But as growth recovers, inflationary concerns could reappear.

Conclusion

- Inflation control could be the main task facing policymakers in 2021. The RBI may have to take steps to gradually drain the excess liquidity in the banking sector, provide a floor for short-term rates, which have fallen below the reverse repo rate, and finally narrow the policy rate corridor by raising the reverse repo rate. A quicker exit from loose monetary policy could become another area where India differs from the world.

NEW BRITAIN

In News

- With new terms of trade between UK and the European Union (EU), there will be multiple glitches in implementing the complex agreement, which guarantees tariff-free trade on most goods between two of the world’s largest economic entities.

- It also lays the basis for future cooperation on law enforcement, security, data flows among other important areas.

About

- EU regrets the separation and looks forward to a new beginning with UK,UK claims a major political victory in regaining its sovereignty to make its own laws and freedom to engage the world on its own terms.

- UK’s success should bring to an end the prolonged political divisions in Britain on the nature of its relationship with Europe after the Second World War.

- Britain had voted with a thin margin to leave the EU in a referendum in 2016; it insisted that the agreement brings “a new stability and a new certainty” to a relationship that has long been fractious and difficult.

Significance

- BREXIT will lead to a significant rearrangement of Britain’s foreign economic policy and international relations.

- London is actively negotiating multiple bilateral FTAs with major economic partners, trying to reinforce the traditional strategic partnerships with the US and Japan and leverage historic connections with Canada, Australia, New Zealand and other Commonwealth nations.

- Britain PM’s visit to India, as the guest at the Republic Day 2021, offers an opportunity for Delhi to take a close look at London’s post Brexit plans and make a big push for the transformation of a bilateral relationship that has long performed way below its natural potential.

- Collaboration in sectors such as digital technology, the climate crisis, and vaccine development will also see a fillip. India remains a top global exporter of raw materials for the pharmaceutical industry and will play an important role in the mass production of the COVID-19 vaccine.

- Under intense pressure to avoid another lockdown, having approved the Pfizer-BioNTech vaccine, and in agreement with India to develop the Oxford vaccine that is yet to be approved, UK has a critical interest in ensuring India’s partnership.

- There are miles to go before this partnership realises it’s true potential, but it is set to become “poll-proof” as India bets on a post-Brexit UK.

GOVERNOR’S ROLE IN ASSEMBLY SESSION

In News

- Kerala government to seek governor’s nod again for special sitting of the Assembly to debate the new three central farm laws. The episode raises questions on the role of a Governor and the contours of the powers he or she has under the Constitution.

- Governor’s powers are limited with regard to summoning the House; there can be no legal ground to deny a request for summoning the session. Governor also criticised the Kerala Assembly’s resolution against the Citizenship Amendment Act, 2019. In the political slugfest, the Governor’s refusal can also be challenged in court.

Who can summon a session of the Assembly?

- According to Article 174, the Governor shall from time to time summon the House or each House of the Legislature of the State to meet at such time and place as he thinks fit. The provision also puts on the Governor the responsibility of ensuring that the House is summoned at least once every six months.

- Although it is the Governor’s prerogative to summon the House, according to Article 163, the Governor is required to act on the “aid and advice” of the Cabinet. So when the Governor summons the House under Article 174, this is not of his or her own will but on the aid and advice of the Cabinet.

Can the Governor refuse the aid and advice of the Cabinet?

- There are a few instances where the Governor can summon the House despite the refusal of the Chief Minister who heads the Cabinet.

- When the Chief Minister appears to have lost the majority and the legislative members of the House propose a no-confidence motion against the Chief Minister, then the Governor can decide on his or her own on summoning the House.

- But the actions of the Governor, when using his discretionary powers can be challenged in court.

How have the courts ruled?

- Supreme Court (SC) has settled the position that the Governor cannot refuse the request of a Cabinet that enjoys majority in the House unless it is patently unconstitutional.

- In 2016 (Nabam Rebia case), SC looked into the constitutional crisis in Arunachal Pradesh after the Governor had imposed President’s Rule in the state. The court read the power to summon the House as a “function” of the Governor and not a “power” he enjoys.

- In ordinary circumstances during the period when the Chief Minister (CM) and his council of ministers enjoy the confidence of the majority of the House, the power vested with the Governor under Article 174 to summon, prorogue and dissolve the house(s) must be exercised in consonance with the aid and advice of the CM and his council of ministers. In the above situation, he is precluded [from taking] an individual call on the issue at his own will, or in his own discretion.

- But the court also clarified that if the governor had reasons to believe that the CM and council of ministers have lost the confidence of the House, a floor test could be ordered.

- Article 163: Governor shall exercise her or his functions with the aid and advice of the council of ministers. But it also adds that Governor would not need their advice if the Constitution requires her or him to carry out any function at her/his discretion.

- Even the Sarkaria Commission of 1983, which reviewed the arrangements between the Centre and the states, had said that “so long as the Council of Ministers enjoys the confidence of the Assembly, its advice in these matters, unless patently unconstitutional must be deemed as binding on the Governor. It is only where such advice, if acted upon, would lead to an infringement of a constitutional provision, or where the Council of Ministers has ceased to enjoy the confidence of the Assembly, that the question arises whether the Governor may act in the exercise of his discretion”.

Conclusion

- The political nature of the office of the Governor, especially in Opposition-ruled states, has been underlined in several instances by courts. The constitutional checks and balances and landmark court rulings account for this and limit the discretionary powers of the Governor.

ZERO COUPON BONDS

In News

- The Central government has issued recapitalisation bonds specifically to Punjab & Sind Bank by issuing the lender Rs 5,500-crore worth of non-interest bearing bonds valued at par that will mature in tranches between 2030 to 2035.

- The market value of these bonds would be around Rs 2,750 crore.

About

- The funds raised through issuance of these instruments, which are a variation of the recapitalisation bonds issued earlier to public sector banks, are being deployed to capitalise the state-run bank.

- Though these will earn no interest for the subscriber, market participants term it both a ‘financial illusion’ and ‘great innovation’ by the government where it is using Rs 100 to create an impact of Rs 200 in the economy.

- It does not affect the fiscal deficit while simultaneously it provides much needed equity capital to the banks. But this may not be a permanent solution for the banking sector’s problems.

- The lender has kept them in the held-to-maturity (HTM) bucket as per the RBI guidelines, not requiring it to book any mark-to-market gains or losses from these bonds.

- Unlike the previous tranches of recapitalisation bonds which carried interest and were sold to different banks, these “non-interest bearing, non-transferable special GOI securities” have a maturity of 10-15 years.

- Traditional zero coupon bonds were issued at discount and were interest bearing.

- Zero coupon bonds by private companies are issued at discount and are tradable, but these special bonds are not tradable, issued by the government specifically to a specified person and are issued at par.

WORLD ECONOMIC LEAGUE TABLE (WELT) 2021

In News

- According to WELT 2021, an annual report published by Centre for Economics and Business Research (CEBR, U.K.-based think tank), India will regain its position as the fifth-largest economy by 2025 and emerge as the third-largest by 2030 in dollar terms and remain in that position until 2035 while China is now forecast to overtake the US economy in 2028, five years earlier than in 2033 as previously forecast.

- This table has forecasts for 193 countries upto 2035 and estimated that the COVID-19 has had a $6 trillion GDP cost in 2020.

About

- India had overtaken the U.K. in 2019 to become the fifth-largest economy. It has been impacted by the COVID-19 pandemic. As a result, after overtaking the U.K. in 2019, the U.K. overtakes India again in this year’s forecasts and stays ahead till 2024 before India takes over again.

- The U.K. appears to have overtaken India again during 2020 as a result of the weakness of the rupee. CEBR forecast that the Indian economy would expand by 9% in 2021 and by 7% in 2022. Growth will naturally slow as India becomes more economically developed, with annual GDP growth expected to sink to 5.8% in 2035.

- Indian would overtake “Germany in 2027 and Japan in 2030”. China would overtake the U.S. to become the world’s biggest economy in 2028, five years earlier than estimated due to the contrasting recoveries of the two countries from the pandemic.

- China’s “skilful management of the pandemic” and the long-term impact the pandemic will have on Western growth means China’s “relative performance has improved.”

- According to the report, one of the impacts of the global health crisis has been to redistribute economic momentum with Asia doing best and Europe worst.

- It notes for instance that authorities reacted “vigorously” to the COVID-19 crisis, thus inflicting less damage on the economy.

- Most Western economies are expected to register negative growth for the year, China is forecast to record a 2 per cent growth rate.

- For some time, an overarching theme of global economics has been the economic and soft power struggle between the United States and China. The COVID-19 and corresponding economic fallout have certainly tipped this rivalry in China’s favour.