Current Affairs (6th August 2021)

Service sector contracts

Context:

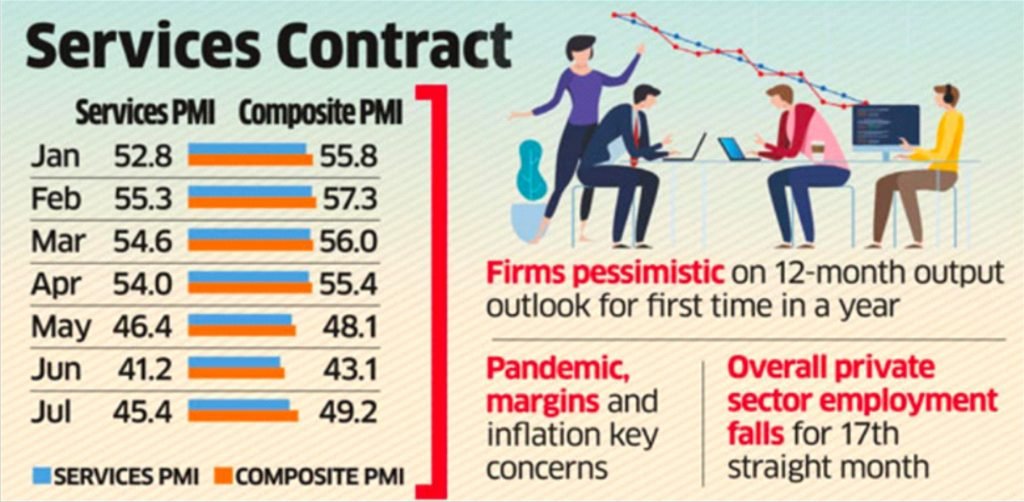

- India’s service sector contracted for the third straight month in July 2021, with job losses extending to an eighth successive month, as per IHS Markit’s Purchasing Managers’ Index.

Highlights:

- India’s overall output, manufacturing and services combined, contracted for the third month in a row as the Composite PMI Output Index was 49.2 in July 2021.

- In June 2021, reading was 43.1.

- A score above 50 indicates an expansion.

- For the first time in a year, services firms were pessimistic about the outlook for the 12-month period on worries about the COVID-19 pandemic, inflation, and profit margins.

- Consumer services were the worst-affected during July 2021.

- It indicates that the unlocking across States had failed to lift confidence in the resumption of contact-sensitive activity.

- The transport and storage were the only subsector to see higher sales in the past month.

- The service sector’s performance in July 2021 is in contrast to the manufacturing sector which logged its highest PMI in three months and saw a pause in job losses for the first time since the pandemic’s onset in March 2020.

- Employment contracted for the eighth consecutive month, albeit at a moderate pace that was slower than that seen in June 2021.

- Private sector employment decreased for the seventeenth month in a row in July 2021.

MPLADS projects lapse

Context:

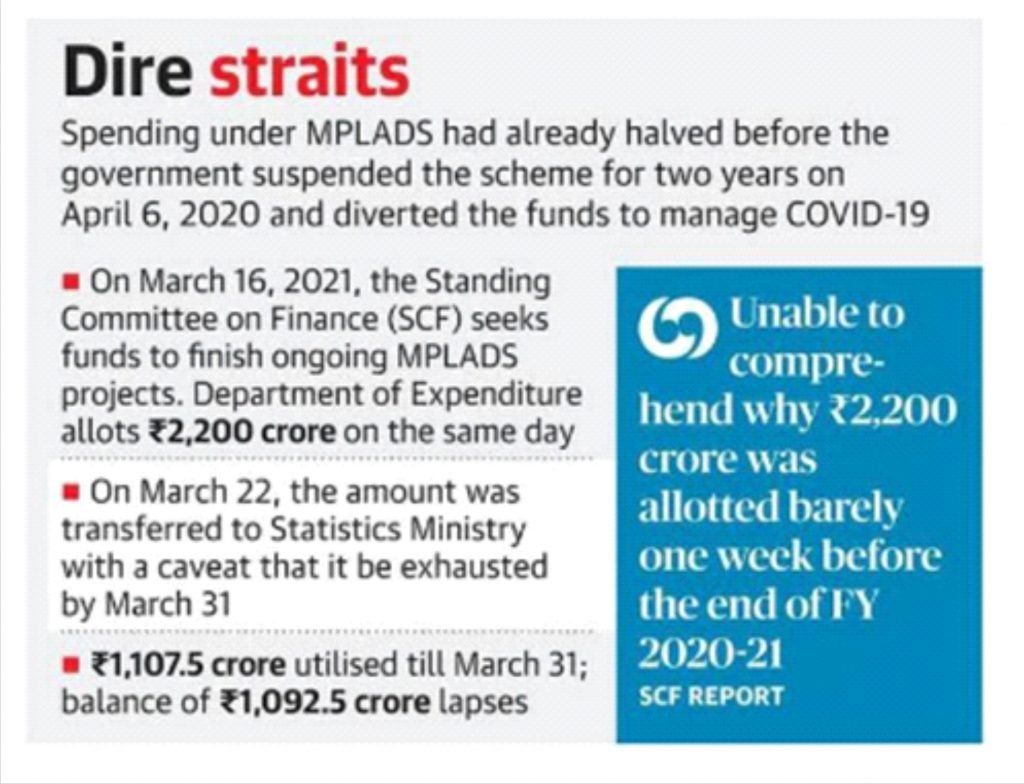

- Virtually half of the belated ₹2,200 crores allotted for completing the ongoing MPLADS projects in 2020-21 simply lapsed, as the Finance Ministry granted “barely a week” to the Ministry of Statistics and Programme Implementation (MoSPI) to release the funds — inviting the ire of the Standing Committee on Finance.

Highlights:

- The resultant funding crunch would have hit several local area development projects under implementation across the country, especially in the five states that went to polls this year as no funds were released for these States and constituencies citing the model code of conduct (MCC).

- Spending under the Members of Parliament Local Area Development Scheme (MPLADS) had already halved before the government suspended the scheme for two years in April last year and diverted the funds for managing the COVID-19 pandemic.

- Each MP is granted ₹5 crores under the scheme, adding up to ₹3,950 crores a year for 790 MPs, to undertake development projects in their respective constituencies.

- After the scheme’s suspension, several MPs and parliamentary committees, including the Standing Committee on Finance (SCF), had asked the government to release MPLADS funds due from previous years for projects already sanctioned.

- An SCF report on the Statistics Ministry’s demands for grants pointed out that many MPLADS projects that began earlier were “left unfinished midway despite the sanction letters being issued and funds for the same were withheld”, citing the suspension of the scheme.

- The panel had sought the release of funds for these projects so that MPs could fulfil their promises to the public.

- The Committee are unable to comprehend the reason why ₹2,200 crores were allotted to MoSPI barely one week before the end of FY 2020-2. This constitutes a serious lapse in fiscal management with negative consequences for communities across India.

‘Tighten norms’:

- The Finance Ministry also asked the Statistics Ministry to further tighten the scheme’s guidelines by September this year, so that “if a work sanctioned by an MP is not used for five years, it will automatically lapse even if there is a committed liability for the work to be completed”.

- Currently, funds released to district authorities under MPLADS is not lapsable, while funds not released by the government in a particular year are carried forward.

GST Version 2.0

Context:

- After four years, the promises of the Goods and Services Tax (GST) remain substantially unrealised.

- A GST version 2.0 may have to be designed soon given the flaws in the existing structure.

What is the overall outcome?

- The goal of avoidance of cascading of various taxes is not met.

- The tax system continues to be a not very transparent multi-rate system.

- There are also associated difficulties in computing and assessing tax liability, tax burden and tax incidence.

- States have less headroom in handling GST collection shortfall after surrendering their fiscal autonomy.

- The tax base of GST does not appear to be expanding as the recent uptick has reversed in July 2021.

- Revenue collection of the GST is dependent on the nominal growth rate of Gross Value Added (GVA) in the economy.

- The Tax to Gross value addition is only about 5% to 6.5% though GVA growth was much higher.

- This indicates that a very large segment is covered by exemption, composition schemes, evasion and lower tax rate.

What are the key challenges in the current GST structure?

- Disputes–

- The fundamental weakness of the GST is its political architecture as it is asymmetrically loaded in favour of the Centre.

- No particular body is tasked to adjudicate disputes, between States and between the Centre and the States, that are inevitable in a tax arrangement as the GST.

- This is despite the fact that the original Constitution (115th Amendment) Bill 2011 (GST Bill) had a provision for such an institution.

- Compensation scheme–

- GST Compensation Cess was introduced to compensate the losses of states for the first 5 years under the GST regime.

- Severe fiscal strain is expected when this 14% compensation comes to an end in 2022.

- The contraction of GST revenue across the country means that the compensation amount will be higher.

- So, the demand for a continuance of compensation scheme is inevitable.

What are the other issues to be resolved?

- Design flaws–

- Nearly 45% to 50% of commodity value is outside the purview of the GST, such as petrol and petroleum products.

- In addition, States which export or have inter-State transfers or mineral and fossil fuel extractions are not getting revenue as the origin States.

- They require a compensation mechanism to get this.

- Most trading and retail establishments, (however small) are out of the fold of the GST.

- At the retail level, irrespective of whether Input Tax Credit (ITC) is required or not, the burden can be passed on to the consumer.

- As a result, the loss could be as high as one third.

- Exemptions–

- Exemptions from registration and taxation of the GST have further eroded the GST tax base compared to the tax base of the pre-existing VAT.

- Exemptions are purely distortionary and directly increase evasion or misclassification, and reduce tax realisation.

- Exclusion–

- Petroleum products remaining outside the purview of GST has helped the Centre to increase cesses and decrease central excise.

- This would have otherwise been shareable with the States.

- In April 2017, cess and surcharge formed 56% and 35% of the excise duty on petrol and diesel, respectively.

- Now, their share has increased to 91% and 85%, respectively.

- But the shareable central excise (with the states) has reduced by ₹6.5 a litre together (both petrol and diesel).

- GSTR–

- Compliance with GST return (GSTR-1) filing stipulation and the resultant tax information is not up to date.

- Also, fraudulent claims of Input Tax Credit (ITC) because of a lack of timely reconciliation are quite high though it has come down by two thirds.

- Tax evasion is at least 5% in minor States and plus 3% in the major States.

What do these call for?

- Instead of the four rates/slabs, a single uniform tax rate for all commodities and services at all stages, inputs and outputs alike, would work better.

- Over all, policy gaps along with compliance gaps need to be addressed.

- Without proper tax information, infrastructure and base, the States would go in for selective tax enforcement.

- In the long run, voluntary compliance will suffer and equity in taxation will be violated.

- Given all these problems, a version 2.0 of GST may have to be designed sooner rather than later.

NATURAL GAS

Context:

- Union Minister for Road Transport and Highways informed Lok Sabha that the share of natural gas in the primary energy mix in India is envisaged to increase to 15% by 2030 by boosting domestic production and procuring LNG.

About:

- LNG imports are under Open General Licensing (OGL) category and establishment of LNG infrastructure, including LNG terminals, is also under 100% FDI (automatic route).

- The market of natural gas is being created by expansion of gas infrastructure, including City Gas Distribution, Gas Grid Network, and establishment of LNG retail outlets.

- This Ministry has notified mass emission standards for Liquefied Natural Gas- driven vehicles.

- It has also notified mass emission norms for agricultural tractors, power tillers, construction equipment vehicles and combined harvesters driven by dual fuel diesel with Liquefied Natural Gas engines.

Plastic-Mixed Handmade Paper

Context:

- Khadi and Village Industries Commission (KVIC) has secured Patent registration for its innovative Plastic-mixed Handmade Paper developed to reduce plastic menace from nature.

About:

- The patent certificate was issued to KVIC’s Kumarappa National Handmade Paper Institute (KNHPI), Jaipur, on 2nd August 2021, by the Controller of Patent, Intellectual Property of India.

- The plastic-mixed handmade paper was developed under Project REPLAN (REducing PLAstic from Nature).

- This is the first of its kind project in India, where plastic waste is de-structured, degraded, diluted, and used with paper pulp while making handmade paper and thus reduces plastic waste from nature.

- The invention is aligned with the Prime Minister’s call for fighting the menace of single-use plastic.

- The technology developed by KVIC uses both high & low density waste polythene that not only adds extra strength to the paper but also reduces the cost by up to 34%. The product is recyclable and eco-friendly.