GST 2.0

Effective from: Midnight, September 22, 2025

Announced after: 56th GST Council Meeting (September 3, 2025)

WHY IN NEWS?

- The Government of India launched a massive GST rate restructuring, known as GST 2.0, affecting 375+ common-use goods and several services.

- Key consumer products now fall under lower GST slabs — aimed at boosting household budgets, reducing inflation, and stimulating demand.

- PM Modi has called this a “GST Savings Festival”, encouraging full benefit pass-through to consumers.

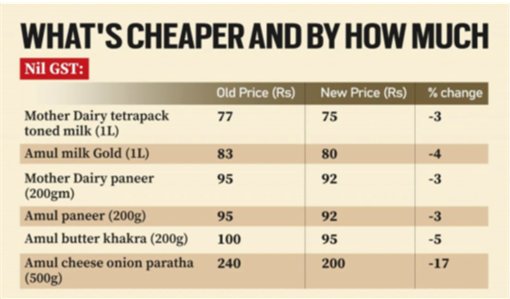

WHAT IS CHEAPER & BY HOW MUCH?

KEY FEATURES

| Category | Previous GST Rate | Revised GST Rate |

| Essential food items (Paneer, Butter, Cheese, etc.) | 5%–18% | 0%–5% |

| Processed food (Cornflakes, Biscuits, Ice Cream) | 12%–18% | 5% |

| Household essentials (Shampoo, Toothpaste, Soap) | 18% | 5% |

| Cement | 28% | 18% |

| Insurance (Health & Life) | 18% | 0% |

| Small Cars | 28% + Cess | 18% (No Cess) |

| Large Cars | Up to 50% (including cess) | 40% Flat |

| Durables (ACs, Dishwashers) | 18% | 12%–15% |

IMPACT ON HOUSEHOLD ITEMS

| Product | Old Price | New Price | % Drop |

| Amul Paneer (200g) | ₹95 | ₹92 | ↓3% |

| UHT Milk (1L – Amul/Mother Dairy) | ₹83/77 | ₹80/75 | ↓3–4% |

| Butter Khakhra (200g) | ₹100 | ₹95 | ↓5% |

| Cheese Onion Paratha | ₹240 | ₹200 | ↓17% |

PACKAGED FOODS & SNACKS

| Product | % Price Reduction |

| Pringles (107g) | ↓12% |

| Kellogg’s Corn Flakes (900g) | ↓11% |

| Sunfeast Marie Light Biscuits (1kg) | ↓12% |

| Ice Cream (50ml cup) | ₹10 → ₹9 (↓10%) |

| Butterscotch Cone (100ml) | ₹35 → ₹30 (↓14%) |

| Product | Price Drop |

| Shampoos, Soaps, Toothpastes | ↓11–13% |

| Brands: L’Oréal, Dove, Himalaya, Close-Up | Lower MRP announced |

IMPACT ON CONSTRUCTION & HOUSING

- Cement: GST reduced from 28% → 18%

- Key for infrastructure, MSMEs, and rural housing

- Major producers (JK Cement, UltraTech) have confirmed full pass-through.

- Expected Price Drop: 8–10% per 50 kg bag

IMPACT ON AUTOMOBILE SECTOR

| Vehicle Type | Tax Before | Tax Now | Price Cut |

| Small Cars | 28% + Cess | 18% | ₹46,000 – ₹1.29 lakh |

| Bigger Cars | 50% | 40% | ₹1.5 – ₹3 lakh (varies) |

| Issues | Dealers facing ₹2,500 crore loss on unsold older inventory |

IMPACT ON INSURANCE

| Policy Type | Old GST | New GST | Savings |

| Health & Life Insurance | 18% | 0% (Exempt) | ↓Up to 15% on annual premiums |

IMPACT ON CONSUMER DURABLES

| Product | Price Reduction |

| 1 Ton Air Conditioners | ₹4,509 – ₹5,259 |

| Dishwashers | ₹3,282 – ₹4,336 |

| Refrigerator, Washing Machine | Expected cuts in next wave |

ECONOMIC & FISCAL IMPLICATIONS

Boost to Consumption

- FMCG and consumer durable sectors likely to see double-digit volume growth in Q3 & Q4 FY26

- May add 2–0.3% to GDP growth due to demand revival

Lower Retail Inflation

- Especially in food & housing components of CPI

- Gives monetary policy space to RBI for rate decisions

Fiscal Impact

- Short-term dip in GST collections may be offset by higher consumption volumes

- Strengthens GST’s pro-poor, pro-consumer orientation

WAY FORWARD

- Strict Monitoring by GST officers to ensure complete pass-through to consumers.

- Extend rate rationalisation to input services to avoid credit accumulation.

- Consider revisiting inverted duty structure in textiles, footwear, electronics.

- Launch GST 2.0 awareness campaign for SMEs, traders, and consumers.

Note: Connect with Vajirao & Reddy Institute to keep yourself updated with latest UPSC Current Affairs in English.

Note: We upload Current Affairs Except Sunday.