Fiscal Deficit

Context:

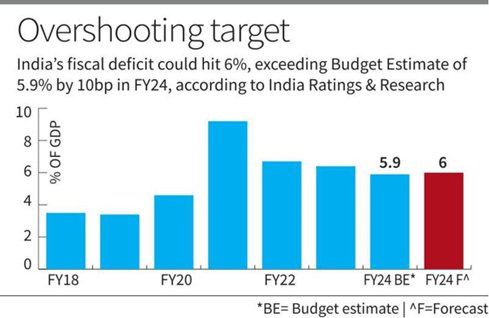

- According to the India Ratings and Research India’s fiscal deficit may breach the 5.9% of GDP target for this year and could hit 6% which is due to the estimate of revenue spending exceeding the Budget Estimate by nearly ₹2 lakh crore.

- This is despite being tax collections have been buoyant which may offset a wide shortfall in disinvestment outcomes.

- It is also being informed that the Centre has recently secured the parliamentary approval for the first supplementary demand for grants this year.

- In the supplementary demand for grants, the government have sought more funds for priority areas which are food, fertilizer, and LPG subsidy.

- Besides that, the government had also sought more funds for the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) in the same supplementary demand for grants.

- One of the major reason for the increased expenditure this year is due to the higher expenditure by a few select Ministries.

- Other main reason is due to the recouping of over ₹28,000 crore in to the Contingency Fund of India which was drawn by about 30 departments as an advance in the past.

What is Fiscal Deficit?

- Fiscal deficit can be described as the difference between total revenue and total expenditure of the government.

- It is usually an indication of the total borrowings required by the government.

- It is important to note that while calculating the total revenue, borrowings are not included.

- Fiscal Deficit can be computed at two levels which are gross fiscal deficit and net fiscal deficit.

- The gross fiscal deficit (GFD) is defined as the excess of total expenditure which include loans net of recovery over revenue receipts (including external grants) and non-debt capital receipts.

- The net fiscal deficit is the gross fiscal deficit minus net lending by the Central government.

- Fiscal deficit in general takes place either due to revenue deficit or a due to major hike in capital expenditure.

- A hike in capital expenditure is considered healthy as capital expenditure is incurred to create long-term assets such as factories, buildings and other development.