GLOBAL MINIMUM CORPORATE TAX (GMCT)

Context :

- Recently, EU Members agreed to implement a minimum global tax of 15% on multinational companies.

- Earlier, 136 countries already agreed to enforce a minimum tax rate of 15% on large MNCs.

What is GMCT deal ?

- In 2021, 136 nations agreed to the GMCT proposal by the OECD which features a 15% corporate minimum tax. Later in its meetings G20 also approved it.

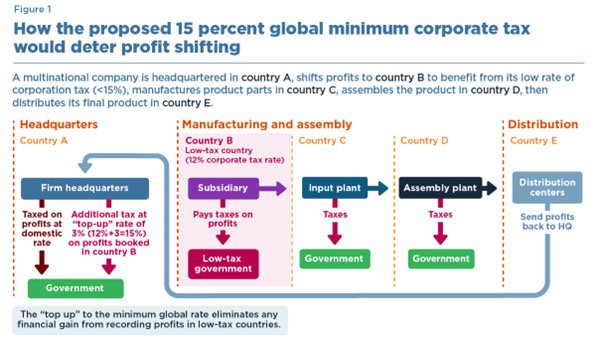

- OBJECTIVE: To address the tax shelling out and profit shifting by large MNEs in low tax or tax haven countries such as Ireland, Bahamas and Panama.

- Timeline: Countries must enact the agreement into law by 2022 in order for it to take effect in 2023.

- G20 consists of two pillars: Pillar 1 and Pillar 2

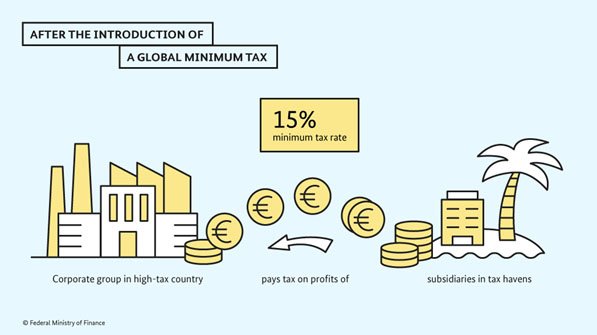

- PILLAR 1- Minimum tax and subject to LOCAL tax rules: Governments can set whatever local corporate tax rates they want, but if companies pay lower rates in a particular country, their home governments could re-tax their taxes to the 15% minimum.

- Thus eliminating the chances of shifting profits to different low tax countries.

- PILLAR 2 – Reallocation of additional share of profit to the market jurisdictions: It allows the countries to tax large MNCs at the rate of 25% if their profit is more is more than 10% of the revenue.

- It is a direct tax of 15% on large MNCs imposed by the governments of the country in which companies are doing business.

NEED OF GMCT :

- The agreement will prevent the countries from racing against each other to cut taxes to attract businesses.

- The double taxation avoidance agreements have been exploited by various companies using the mismatches between the taxation laws of different countries.

- According to OECD the minimum tax will generate $150 billion in additional global tax revenues annually.

- It will help the countries to build back their economy which got severely battered by COVID-19 pandemic.

GMCT predecessor arrangements :

- Equalisation levy – Based on the recommendations of Akhilesh Ranjan Committee in 2016, India became the first country to implement the equalisation levy.

- Countries like Belgium, Britain, India and Indonesia have introduced Digital Services Taxes on local sales of foreign firms with online platforms.

CHALLENGES IN GMCT DEAL :

- Oxfam International criticised the deal arguing that the minimum corporate tax rate of 15% is too low.

- Simultaneous implementation of law by all the signatories will be a cumbersome process.

- It is also an attack upon the nation’s sovereign right to decide a nation’s tax policy.

- Due to lack of enforcement powers, Oxfam also said the deal would not put an end to tax havens.

- It has no provision to tackle tax evasion and would make rigid tax commitments with little or no flexibility at all.

GMCT and INDIA :

- Enactment of GMCT requires India to abolish the policies of past and switch to the proposed two-pillar international norms.

- India had already taken measures to minimise tax evasion by foreign corporates. Like Equalisation levy, Special Economic Presence (SEP) rules, digital services tax, Tax Information Exchange Agreements (TIEAs) with tax havens.

- India loses about $10billion to tax abuse through profit shifting every year. This is the second-largest tax revenue loss in Asia.

- According to Tax Justice Network, India to gain about $4billion annually under this new global taxation system.

- Existing corporate tax in India is above the proposed global minimum of 15%, thus the chances of a dip in FDI is not worrisome.

- It will also help attract foreign investments.

- It will help provide tax concessions to big companies without compromising the tax rates.

WAY FORWARD :

- Many believe that the plan will help counter rising global inequality by making it tougher for large businesses to pay low taxes by availing the services of tax havens.

- It will also help governments collect the revenues required for social spending.

- Supporters of the OECD’s tax plan also believe that it will end the global “race to the bottom”.

- On the other hand critics also argue that without tax competition between governments, the world would be taxed a lot more than it is today, thus adversely affecting global economic growth.

Syllabus : GS3 – Issues affecting Indian Economy