GREEN BONDS

Context:

- Recently RBI announced that it will issue Sovereign Green Bonds (SGBs) worth Rs 16000 Cr in two tranches of Rs 8000 Cr for the first time.

- RBI also said it would issue green bonds of 5year and 10 Year tenure.

- The announcement is in sync with India’s commitment to achieving net zero carbon emissions by 2070.

The framework comes close in the footsteps of India’s commitments under “Panchamrit” as elucidated by Prime Minister Narendra Modi at COP26 at Glasgow in November 2021.

WHAT ARE SOVEREIGN GREEN BONDS?

- Green bonds are bonds issued by any sovereign entity, inter-governmental groups or alliances and corporates with the aim that the proceeds of the bonds are utilised for projects classified as environmentally sustainable.

- These rupee-denominated papers will have a long tenure to suit the requirement of green infrastructure projects.

- The projects can include renewable energy, clean transportation and green buildings, among others.

- These bonds are typically asset-linked and backed by the issuing entity’s balance sheet, so they usually carry the same credit rating as their issuers’ other debt obligations.

- These instruments have lower capital costs than regular bonds.

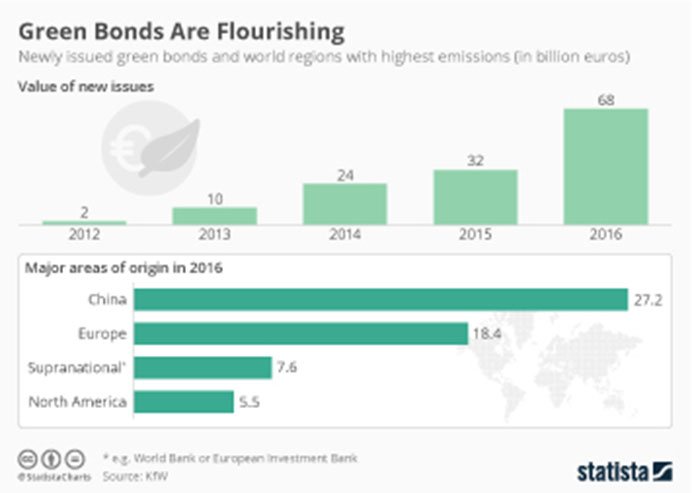

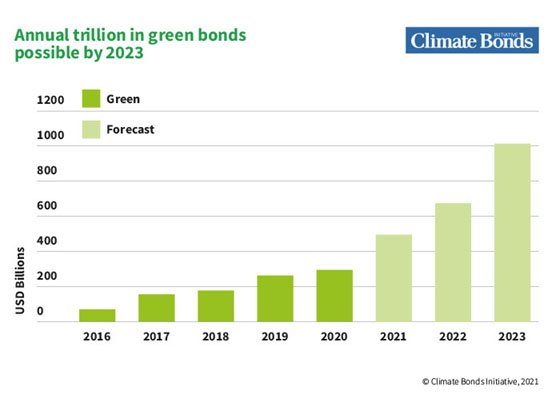

- The international green bond market has seen cumulative issuance worth more than USD 1 trillion since market inception in 2007.

These are called “green” on the basis of four key principles.

These include:-

- encouraging energy efficiency in resource utilisation,

- reducing carbon emissions and greenhouse gases,

- promoting climate resilience and

- improving natural ecosystems and biodiversity, especially in accordance with SDG (Sustainable Development Goals).

AIM AND OBJECTIVES OF GREEN BONDS:

- They are aimed at addressing concerns such as energy efficiency, pollution prevention, sustainable agriculture, fishery and forestry, the protection of aquatic and terrestrial ecosystems, clean transportation, clean water, and sustainable water management.

- According to the International Finance Corporation (IFC), a World Bank Group’s institution, climate change threatens communities and economies, and it poses risks for agriculture, food, and water supplies.

- They also finance the cultivation of environmentally friendly technologies and the mitigation of climate change.

HOW WILL IT BE BENEFICIAL TO INVESTORS?

- They provide a means to hedge against climate change risks while achieving at least similar, if not better, returns on their investment.

- It will provide benchmark pricing, liquidity and a demonstration effect for local issuers, helping to support the growth of a local market.

- It will also work as a catalyzer in domestic market development and provides impetus to institutional investors.

GOVERNMENT AND GREEN BONDS:

- The issuance of the Sovereign Green Bonds will help the Indian government in tapping the requisite finance from potential investors for deployment in public sector projects aimed at reducing the carbon intensity of the economy.

- Green bonds may carry lower interest rate than that for regular government borrowings.

- Green bonds are one form of dated security. It will have a tenure and interest rate. Money raised through these will be part of overall government borrowing.

- The government said it stands committed to reduce Emissions Intensity of GDP by 45 per cent from the 2005 level by 2030, and achieve about 50 per cent cumulative electric power installed capacity from non-fossil fuel-based energy resources.

SIGNIFICANCE OF SOVEREIGN GREEN BONDS:

- It will help the Indian government in tapping the requisite finance from potential investors for deployment in public sector projects aimed at reducing the carbon intensity of the economy.

- Development of a sovereign green benchmark could eventually lead to the creation of a vibrant ecosystem of raising green bonds from international investors.

- It will help kickstart large inflows of capital.

- Investments will be made in renewable energy such as solar and wind.

UTILISATION OF FUNDS:

- The government will use the proceeds raised from Bonds to finance or refinance expenditure (in parts or whole) for various green projects, including in renewable energy, clean transportation, energy efficiency, climate change adaptation, sustainable water and waste management, pollution and prevention control and green buildings.

WAY FORWARD:

HARMONISATION OF GREEN BONDS :

Government should strive to harmonise international and domestic guidelines and standards for green bonds to develop a robust green bond market.

RAISING AWARENESS :

Proper leveraging of private sector as capacity building measures for issuers in emerging economies to spread knowledge on the benefits and related processes and procedures related to green bonds would help in addressing the institutional barriers to entry into this market and will help in attracting the investors.

Syllabus – Mains, GS-2,3.