DISINVESTMEN

WHY IN NEWS ?

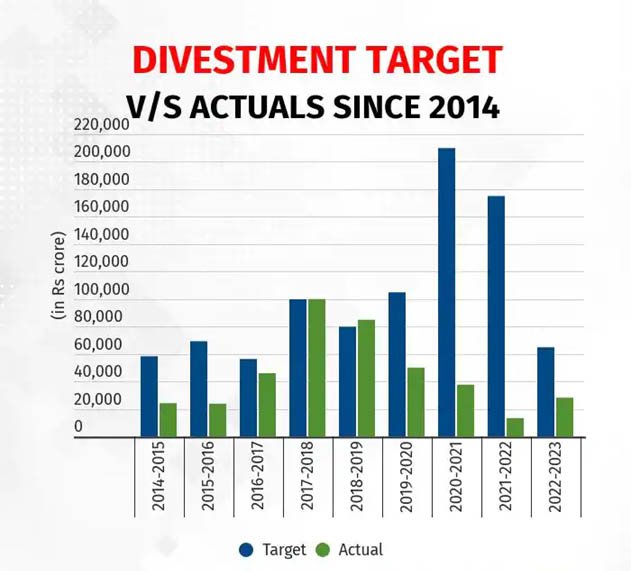

- For a record fifth year in a row, it is seemingly that the government is set to miss its divestment target.

WHAT IS DISINVESTMENT?

- It is the action of an organization or government selling or liquidating an asset or subsidiary.

- It can take the form of divestment or a reduction of total capital expenditures.

- It is carried out for a variety of reasons, such as strategic, political, or environmental.

AIMS AND OBJECTIVES OF DISINVESTMENT:

- As per the New economic policy of 1991, “The PSUs had shown a very negative rate of return on capital employed”.

- Due to inefficient PSUs, the national gross domestic product and gross national savings were also getting adversely affected by low returns from PSUs.

- Around 10 to 15 % of the total gross domestic savings were getting reduced on account of low savings from PSUs.

The following are the main objectives of disinvestment:

- To reduce the financial burden on the Government

- To improve overall public finances

- To introduce the competition and market discipline

- To fund the growth in economy

- To encourage wider share of ownership

- To depoliticise non-essential services

WHAT ARE THE CHANGES IN GOVERNMENTS STRATEGY:

- According to Union government, it has decided to approach its investments in central public sector enterprises (CPSEs) from a capital management point of view rather than looking at it through the prism of fiscal deficit.

- The government will look at both divestment and dividends from CPSEs combinedly.

- The government has decided against setting a specific divestment target in the budget.

- In the current interim budget, the government has thus budgeted ₹50,000 crore as ‘miscellaneous capital receipts’ for 2024-25 and this also includes asset sales apart from divestments.

- The government also clarified that it will take a pragmatic and calibrated approach towards divestments.

WHY DID THE GOVERNMENT CHANGED STRATEGY?

- For the consecutive fifth year, the NDA government is likely to fall well short of meeting its divestment target.

- Such figures are despite bringing in a progressive reduction in divestment targets over the years.

- As per interim budget, for 2023-24, it has revised downwards its original target of ₹51,000 crore to ₹30,000 crore in the interim budget.

- In the last five years, the government has only managed to raise ₹2.34 trillion from divestment of mostly from minority stake sales as against a set target of ₹6.86 trillion.

IMPORTANCE OF DISINVESTMENT:

- As per various scholars , “The governments are not good at doing business and should stay out of it”.

- The government has no business to remain in business.

- The other importances of disinvestment is that the efficient productivity and economic management of the companies.

- From 2017-18 to 2021-22, the CPSEs incurred a loss of staggering amount of ₹1.54 trillion.

- As Air India, before its sale, was losing ₹20 crore a day. Funding of these losses is a bad way to deploy public finances.

- Divestment will also make CPSEs efficient and help raise money that can be used to reduce government debt and reduce the fiscal deficit.

- It will also ensure better allocation of resources and catalyze overall economic growth.

CONCERNS REGARDING DISINVESTMENT:

- The suitable timing of a divestment is the key to getting the right valuation.

- In the past, pandemic and geo-political crises had turned the capital market sentiments bad.

- The political support for divestment is lacking.

- As the most labour unions oppose it and have filed legal cases.

- State governments showing no enthusiasm is another concern.

- Some divestments have also been derailed due to some poor-quality bidders. Divestment of BPCL, Pawan Hans, IDBI, Concor, Shipping Corporation of India and NMDC have been held up for these reasons.

SUCCESSES IN GOVERNMENT DISINVESTMENT:

- The disinvestment of Air India in 2020-21 is the biggest success regarding disinvestment.

- The government also offered 3.5% of its stake in LIC through an IPO and raised ₹20,516 crore.

- On the other hand, IREDA’s IPO earlier this fiscal raised ₹858 crore.

- Other disinvestments from Coal India, Rail Vikas Nigam, IRCON, ONGC, IRCTC and HAL account for a large share of divestment realization in recent years.