Current Affairs (31st July 2021)

Insolvency and Bankruptcy Code (IBC) (Amendment) Bill, 2021

Context:

- Recently, the Insolvency and Bankruptcy Code (IBC) (Amendment) Bill, 2021 has been passed by the Lok Sabha.

About:

- It proposed the Pre-packaged Insolvency Resolution Process (PIRP), also called ‘pre-packs’ as an insolvency resolution mechanism for Micro, Small and Medium Enterprises (MSMEs).

- It will replace the Insolvency and Bankruptcy Code (Amendment) Ordinance, 2021, which was promulgated on 4th April 2021.

Pre-pack:

- It envisages the resolution of the debt of a distressed company through a direct agreement between secured creditors and the existing owners or outside investors, instead of a public bidding process.

- Under the pre-pack system, financial creditors will agree to terms with the promoters or a potential investor and seek approval of the resolution plan from the National Company Law Tribunal (NCLT).

- The approval of at least 66 per cent of financial creditors that are unrelated to the corporate debtor would be required before a resolution plan is submitted to the NCLT.

- The NCLTs will be required to either accept or reject an application for a pre-pack insolvency proceeding before considering a petition for a Corporate Insolvency Resolution Process (CIRP).

- This system has become an increasingly popular mechanism for insolvency resolution in the United Kingdom (UK) and Europe over the past decade.

Advantages of Pre-packs:

- Pre-packs are largely aimed at providing MSMEs with an opportunity to restructure their liabilities and start with a clean slate.

- Benefits of Pre-Packs over CIRP:

- CIRP is a time taking process due to prolonged litigation by erstwhile promoters and potential bidders.

- At the end of December 2020, over 86 per cent of the 1717 ongoing insolvency resolution proceedings had crossed the 270-day threshold.

- The pre-pack in contrast is limited to a maximum of 120 days with only 90 days available to the stakeholders to bring the resolution plan to the NCLT.

- In case of CIRP, a resolution professional takes control of the debtor as a representative of financial creditors while in case of pre-packs, the existing management retains control, allowing for minimal disruption of operations.

- CIRP is a time taking process due to prolonged litigation by erstwhile promoters and potential bidders.

- Protection to Creditors

- It will provide adequate protections so that the system is not misused by firms to avoid making payments to creditors.

- Currently, only corporate debtors themselves are permitted to initiate a PIRP after obtaining the approval of 66 per cent of their creditors.

- However, the pre-pack mechanism allows for a Swiss challenge to any resolution plan that provides less than full recovery of dues for operational creditors.

- Under the Swiss challenge mechanism, any third party would be permitted to submit a resolution plan for the distressed company and the original applicant would have to either match the improved resolution plan or forgo the investment.

- Creditors are also permitted to seek resolution plans from any third party if they are not satisfied with the resolution plan put forth by the promoter.

- It will provide adequate protections so that the system is not misused by firms to avoid making payments to creditors.

- It helps corporate debtors to enter consensual restructuring with lenders and address the entire liability side of the company.

Challenges:

- According to experts, the timeline for the PIRP may be difficult to meet for lenders and distressed firms.

- Forensic audits were particularly important in cases where the control of the firm remains with the same management. Ordinarily where haircuts are involved, forensic/transaction audits become imperative, and a negative report becomes a roadblock in resolution involving the same management.

- The term haircut is most used when referencing the percentage difference between an asset’s market value and the amount that can be used as collateral for a loan.

- If a firm restructures its outstanding debt through a PIRP with the existing management retaining control, the Non-Performing Asset (NPA) status of the company’s account with lenders may not be automatically upgraded under Reserve Bank of India (RBI) guidelines.

- It has also been noted that the debtor-in-possession model may militate against the Swiss challenge option, as the existing management may create hurdles for an outside investor seeking information to potentially invest in the company.

- Under CIRP, a resolution professional is in charge of running the company and providing information to potential investors.

Way Forward:

- The government should consider setting up specific benches of the NCLT to deal with pre-pack resolution plans to ensure that they are implemented in a time-bound manner.

- To motivate resolution under the PIRP, the RBI guidelines on account status may be aligned with the objective of IBC.

- The lenders may be given the benefit of account upgradation upon resolution. There is a need for the Insolvency and Bankruptcy Board of India (IBBI) and RBI to find middle ground on these regulations to make the PIRP more attractive.

- The pre-pack mechanism is effective in arriving at a quick resolution so it should be rolled out to all corporations over time as legal issues are settled through case law.

Geo-imaging Satellite EOS-03

Context:

- This satellite is scheduled for launch in third quarter of 2021. ISRO realized EOS-03 is capable of imaging the whole country 4-5 times daily.

About:

- Earth Observation Satellites (EOS) is a remote sensing satellite designed for Earth observation (EO) from orbit, including spy satellites and those used for non-military uses.

- Purpose – This satellite would enable near-real time monitoring of natural disasters like floods & cyclones.

- In addition to natural disasters, EOS-03 would also enable monitoring of water bodies, crops, vegetation condition, forest cover changes

Small Satellite Launch Vehicle

Context:

- The first developmental flight of Small Satellite Launch Vehicle (SSLV) is scheduled in fourth quarter of 2021 from Satish Dhawan Space Centre, Sriharikota.

About:

- SSLV was developed by the ISRO as a cost-effective, three-stage, all-solid launch vehicle with a payload capability of 500 kg to 500 km planar orbit or 300 kg to Sun Synchronous Polar Orbit.

- It is shorter in length than the PSLV and GSLV. Unlike the PSLV and GSLV, the SSLV can be assembled both vertically and horizontally.

- The major technologies developed as part of realization of SSLV are,

- Flexible nozzle control with electro-mechanical actuators for all stages,

- Miniaturized avionics and

- A velocity trimming module in the upper stage for precise satellite injection.

- SSLV is ideal for on-demand, quick turn-around launch of small satellites.

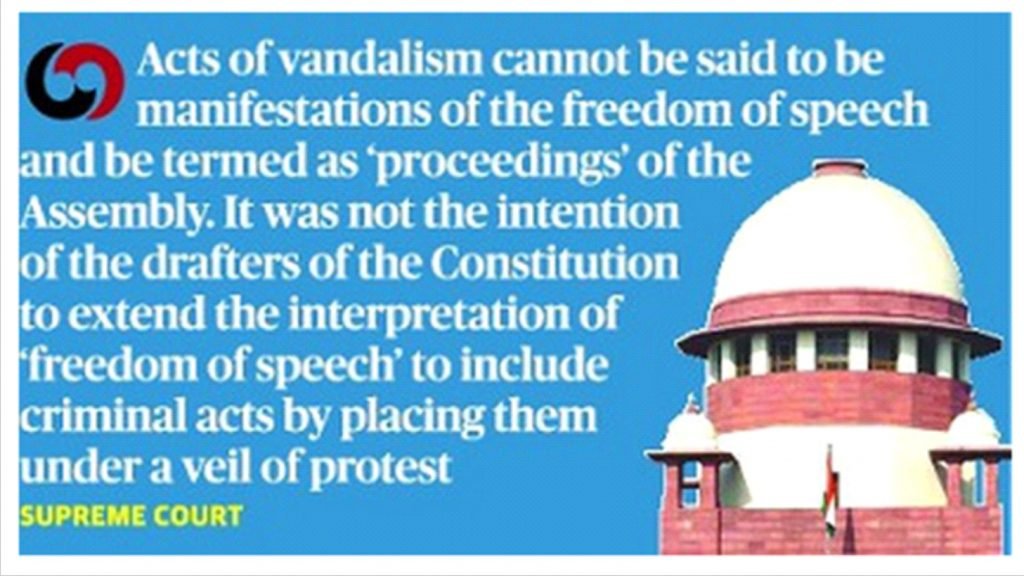

Vandalism

Context:

- The Supreme Court held that lawmakers cannot indulge in criminal acts on the Parliament or Assembly floors and then take cover behind the right to free speech.

About:

- The court refused the Kerala government’s plea to withdraw prosecution of top Left Democratic Front (LDF) leaders accused of vandalism and wanton destruction of public property on the Assembly floor during a Budget speech in 2015.

- Acts of vandalism cannot be said to be manifestations of freedom of speech and be termed as ‘proceedings’ of the Assembly.

- It was not the intention of the drafters of the Constitution to extend the interpretation of ‘freedom of speech’ to include criminal acts by placing them under a veil of protest.

- Legislators cannot unleash violence, run riot in Parliament or a Legislative Assembly and then claim parliamentary privilege and immunity from criminal prosecution.

- Parliamentary privileges and immunities are not “gateways” for legislators to claim exception from the law of the land, especially criminal law.

- The court explained that the purpose of bestowing privileges and immunities to elected members of the legislature was to enable them to perform their “essential functions” without hindrance, fear, or favour The ‘essential’ function of the House is collective deliberation and decision-making.

Inland Vessels Bill 2021

Context:

- The Inland Vessels Bill 2021 was passed in Lok Sabha.

About:

- It replaces the Inland Vessels Act, 1917.

- The Bill seeks to introduce a uniform regulatory framework for inland vessel navigation across the country.

Mechanically propelled inland vessels:

- The Bill defines such vessels to include ships, boats, sailing vessels, container vessels, and ferries.

- The central government will prescribe the:

- Classification,

- Standards of design, construction, and crew accommodation, and

- Type and periodicity of surveys, for these vessels.

Certificates:

- To operate in inland waters, all such vessels must have a certificate of survey, and a certificate of registration.

- Vessels with Indian ownership must be registered with the Registrar of Inland Vessels (appointed by the state government).

Insurance:

- The vessels must also have an insurance policy to cover liability for death, injury, or damage caused due to the usage of the vessel (including accidental pollution).

Navigation safety:

- Such vessels will be required to follow certain specifications for signals and equipment to ensure navigation safety, as specified by the central government.

Inquiry into accidents:

- All accidents aboard such vessels must be reported to the head officer of the nearest police station, as well as to a state government appointed authority.

Manning requirements:

- The central government will prescribe the minimum number of people that vessels must have, for various roles. Violating these requirements will attract a penalty of up to Rs 10,000 for the first offence, and Rs 25,000 for subsequent offences.

Prevention of pollution:

- Vessels will discharge or dispose sewage, as per the standards specified by the central government. State governments will grant vessels a certificate of prevention of pollution, in a form as prescribed by the central government.

Development fund:

- The Bill provides for a development fund which will be utilised for various purposes including: (i) emergency preparedness, (ii) containment of pollution, and (iii) boosting inland water navigation. Each state will constitute such a development fund.

Non-mechanically propelled inland vessels:

- The Bill empowers state governments to delegate certain functions related to non-mechanically propelled inland vessels to their local governments.