FOREIGN CONTRIBUTION REGULATION ACT

- In November 2024, the Ministry of Home Affairs (MHA) issued a notice listing 17 reasons for which the Foreign Contribution (Regulation) Act (FCRA) registration of NGOs (Non-Governmental Organizations) may be denied or canceled.

- These reasons mainly address concerns about national security, social harmony, misuse of foreign funds, and the involvement of NGOs in anti-national activities.

- The list signals a tightening of controls over NGOs receiving foreign donations, showing the government’s focus on ensuring that foreign funds are not used in ways that could harm India’s sovereignty, security, or public order.

What is the FCRA?

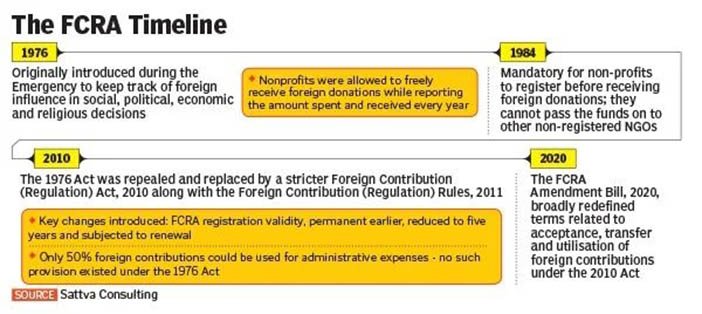

- The Foreign Contribution (Regulation) Act (FCRA) was enacted in 1976 during the Emergency period to regulate the flow of foreign contributions into India.

- Its primary purpose is to ensure that foreign donations to Indian NGOs do not adversely affect national interests, sovereignty, or internal security.

Key Objectives of FCRA:

- To regulate the acceptance and utilization of foreign funds by NGOs.

- To ensure that foreign funds do not negatively impact India’s sovereignty, democratic values, or internal security.

NOTE:

- No Foreign Contributions from NRIs: Contributions from Non-Resident Indians (NRIs) using their personal savings through normal banking channels are not considered foreign contributions.

- Transparency & Monitoring: NGOs are required to disclose the full details of foreign donations and how the funds are used to ensure transparency.

ABOUT FCRA

AMENDMENTS IN FCRA (OVER THE YEARS)

- 2010 Amendment:

- Streamlined regulations for receiving foreign contributions.

- Prohibited the use of foreign donations for activities harmful to national interests.

- 2020 Amendment:

- Aadhaar Mandate: Required Aadhaar numbers for key functionaries of NGOs.

- Designated Bank Account: Foreign funds must be routed through an FCRA-approved account at the State Bank of India.

- Domestic Transfer Ban: Prohibited NGOs from transferring foreign funds to other domestic entities.

- Administrative Expense Limit: Reduced the cap on administrative expenses from 50% to 20% of foreign funds received.

WHO NEEDS FCRA REGISTRATION?

Any organization, association, or NGO wishing to receive foreign donations must be

registered under the FCRA. This includes a variety of NGOs working in social, educational,

economic, or religious fields.

- Validity & Renewal: FCRA registration is valid for 5 years and can be renewed if the organization complies with FCRA norms.

- Permissible Uses of Foreign Contributions: Foreign funds can only be used for activities that serve social, educational, cultural, or economic purposes and contribute positively to the nation.

MONITORING AUTHORITY

The Ministry of Home Affairs (MHA) is the regulatory body responsible for ensuring FCRA compliance by NGOs.

Key Developments in FCRA Implementation:

- In 2015, NGOs were required to maintain their bank accounts with core banking facilities for better monitoring.

- In 2023, an amendment mandated that NGOs disclose assets created with foreign funds in their annual returns.

17 REASONS FOR DENYING FCRA REGISTRATION

The MHA has outlined 17 specific reasons for denying or canceling the FCRA registration of NGOs, focusing on misuse of foreign funds and activities that may pose a threat to national security or social harmony. These include:

- Anti-Development Activities: NGOs found using foreign funds for activities detrimental to India’s development will have their registration revoked.

- Inciting Malicious Protests: If funds are used to instigate protests that disrupt public order or destabilize the country.

- Religious Conversion Activities: Involvement in forced or induced religious conversion or proselytizing.

- Links with Terrorist or Anti-National Organizations: Ties with organizations or individuals involved in terrorism or activities against India’s sovereignty.

- Misuse of Foreign Funds: Diversion of funds for activities threatening national security or public order.

- Personal Gain by Office Bearers: Use of foreign contributions by office bearers for personal enrichment.

- Defunct or Non-Operational NGOs: If the NGO is found to be inactive or non-operational for a long period.

- Failure to Submit Annual Returns: Non-submission of required annual returns is grounds for cancellation.

- Non-Compliance with NGO’s Objectives: If funds are not used for the purpose the NGO originally registered for.

- Adverse Field Inquiry Reports: If investigations suggest that an NGO’s activities are harmful to social or religious harmony.

- Prosecution Pending: Criminal investigations or prosecutions against office-bearers or key functionaries.

- Lack of Transparency: Failure to provide necessary documents or explanations when sought by authorities.

- Non-Cooperation with Investigations: Refusal to comply with investigations or government directives.

- Failure to Maintain Accountability: Lack of proper financial records or failure to submit audit reports on foreign funds.

- False Representation of Activities: Misrepresentation of activities or impact to justify foreign funding.

- Radical Organization Links: Associations with radical or extremist groups.

- Involvement in Anti-National Activities: Direct involvement in activities that undermine India’s sovereignty or security.

CONSEQUENCES OF FCRA CANCELLATION

- Prohibition from Re-Registration: If an NGO’s registration is canceled, it cannot re apply for FCRA registration for three years.

- Suspension: The government can suspend an NGO’s registration for up to 180 days while investigations are ongoing, and financial assets can be frozen.

- Legal Recourse: NGOs can appeal the cancellation of their FCRA registration in the High Court.

Note: Connect with Vajirao & Reddy Institute to keep yourself updated with latest UPSC Current Affairs in English.

Note: We upload Current Affairs Except Sunday.