INDIA RISES TO 15TH POSITION IN FDI DESTINATIONS

Why in News?

Released: June 19, 2025 |

Published by: United Nations Conference on Trade and Development (UNCTAD)

INDIA’S FDI PERFORMANCE

Global Ranking

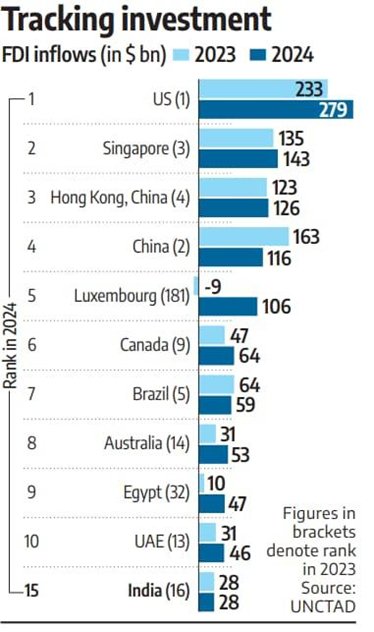

- In 2024, India rose to the 15th position globally for FDI inflows, improving from 16th in 2023.

- This rise occurred despite an 11% decline in global FDI flows, marking India as a stable destination for foreign investment.

FDI Inflows and Trends

- India maintained $28 billion in FDI inflows in 2024, the same level as 2023.

- This stability is considered a positive sign after a significant 43% drop in 2023 from the previous year.

OTHER FDI METRICS

- According to the Reserve Bank of India (RBI), net FDI (excluding repatriation) stood at approximately $29 billion for FY25.

- Data from the Department for Promotion of Industry and Internal Trade (DPIIT) indicated FDI equity inflows of $50 billion, representing a 13% increase in FY25.

India’s Standing in Developing Asia

- India attracted 46% of all international private equity investment in developing Asia, making it the leading recipient in the region.

INVESTMENT CATEGORIES

Greenfield Projects

- India retained its 4th position globally for greenfield project announcements.

- In 2024, a total of 1,080 greenfield projects were announced.

- The projected capital expenditure surged over 25%, reaching $110 billion—almost one-third of Asia’s total greenfield investments.

- This growth reflects strong long-term industrial investment interest in India.

International Project Finance (IPF)

- India ranked among the top five countries for IPF deals, with 97 transactions.

- However, India slipped from its 2nd place ranking in 2023.

OUTWARD FDI

- India improved its position in outward investments, ranking 18th globally in 2024.

- Outward FDI flows reached $24 billion, up from 23rd position and lower volumes in 2023.

KEY SECTORS ATTRACTING INVESTMENT

- Renewable Energy

- Semiconductors

- Basic Metals

- Digital Infrastructure

- Notably, Microsoft committed $3 billion to build out cloud and AI infrastructure in India.

- The report also highlighted M&A activity, such as:

- Walt Disney’s $3 billion merger with Viacom18, forming a majority Indian-owned joint venture.

- International pharmaceutical operations being sold to Indian companies.

GLOBAL FDI CONTEXT

Global Trends

- Global FDI dropped by 11% in 2024, marking the second consecutive year of decline.

- This decline excludes volatile conduit flows through select European countries.

- The outlook for 2025 remains pessimistic due to geopolitical tensions and economic uncertainty.

TOP FDI DESTINATION COUNTRIES

| Rank | Country | FDI Inflows |

| 1 | United States | $279 billion |

| 2 | Singapore | (Moved up) |

| 3 | Hong Kong | (Moved up) |

| 4 | China | $116 billion (29% decline) |

Regional Patterns

- Africa: FDI rose by 75%, largely driven by a megaproject in Egypt.

- Developing Asia: Received $605 billion in FDI (a slight 3% decline).

- ASEAN (Southeast Asia): FDI grew by 10%, defying global trends.

FDI IN SUSTAINABLE DEVELOPMENT GOALS

- Investment in SDG-related sectors fell sharply in 2024:

- Infrastructure, renewable energy, water/sanitation, agrifood: Down 25–33%.

- Only the health sector saw modest growth (from a low base).

- International Project Finance (IPF) fell 26% globally, severely affecting Least Developed Countries (LDCs).

DIGITAL ECONOMY INVESTMENTS

- FDI into the digital economy increased by 14% in 2024.

- However, 80% of greenfield digital projects in the Global South were concentrated in just 10 countries, including India.

- This highlights an uneven distribution of digital investment across developing nations.

WHAT IS FDI?

Foreign Direct Investment (FDI) refers to an investment made by a person or company based in one country into a business or asset located in another country. Unlike portfolio investment (such as buying stocks or bonds), FDI involves significant ownership, control, or influence over the foreign business.

KEY FEATURES

- Long-Term Interest: FDI implies a lasting interest in the foreign enterprise, not just a short-term financial investment.

- Ownership or Control: It usually involves acquiring at least 10% of the equity in a foreign company, giving the investor some control over management decisions.

- Active Participation: The investor often participates in the decision-making and operations of the foreign business.

TYPES OF FDI

| Type | Description |

| Greenfield FDI | Establishing a new business or facility in a foreign country (e.g., factory, office). |

| Brownfield/ M&A | Acquiring or merging with an existing foreign company. |

| Joint Ventures | Partnering with a local company to operate a business together. |

Examples

- Amazon investing in warehouse infrastructure in India (Greenfield FDI).

- Tata Motors acquiring Jaguar Land Rover in the UK (Brownfield/M&A).

- Toyota forming a joint venture with Kirloskar Group in India.

BENEFITS & RISKS

- Brings in capital, technology, and expertise.

- Creates employment and boosts infrastructure.

- Increases exports and integrates the local economy into global supply chains.

Risks and Concerns

- Can lead to foreign dominance in key sectors.

- Potential for profit repatriation, where profits are sent back to the investor’s home country.

- Risk of exploitation of natural resources or local labor.

FDI IN INDIA

India receives FDI across multiple sectors including:

- Information Technology

- Telecommunications

- Pharmaceuticals

- Renewable Energy

- Retail and E-commerce

The Indian government regulates FDI through policies published by the Department for Promotion of Industry and Internal Trade (DPIIT). Some sectors allow 100% FDI through the automatic route, while others require government approval.

Note: Connect with Vajirao & Reddy Institute to keep yourself updated with latest UPSC Current Affairs in English.

Note: We upload Current Affairs Except Sunday.