STRAIT OF HORMUZ CLOSURE THREAT

Context: June 2025

Trigger: U.S. airstrikes on Iran’s nuclear facilities

Reaction: Iran’s Parliament passed a motion recommending closure of the Strait of Hormuz

WHY IN NEWS?

- In June 2025, following U.S. military strikes on Iran’s nuclear facilities, Iran’s Parliament approved a resolution to close the Strait of Hormuz as retaliation.

- The final decision rests with Iran’s Supreme National Security Council, which operates under the Supreme Leader.

- This move has raised global concerns about oil supply disruptions and economic instability.

ABOUT STRAIT OF HORMUZ

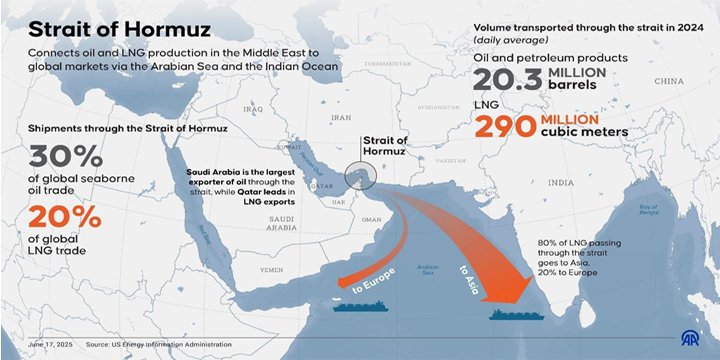

| Feature | Details |

| Location | Between Iran (north) and Oman & UAE (south) |

| Width | ~50 km at entrance; ~33 km at narrowest point |

| Function | Connects Persian Gulf to Gulf of Oman and Arabian Sea |

| Legal Status | Lies within territorial waters of Iran and Oman |

| Importance | World’s busiest oil transit chokepoint |

| Volume of Trade | ~20 million barrels/day (~20% of global oil supply) |

| Annual Value | ~$600 billion in oil and gas trade (U.S. EIA estimate) |

| Main Exporters | Iran, Iraq, Saudi Arabia, UAE, Kuwait, Qatar |

| Main Importers | India, China, Japan, South Korea |

WHAT COULD HAPPEN IF THE STRAIT IS CLOSED?

1. Oil Prices Could Surge

- Oil prices may jump from $77 to $120–$150 per barrel.

- This would raise fuel costs globally and affect domestic inflation in many countries.

2. Stock Markets and Trade Would Suffer

- Global stock markets may react negatively due to uncertainty.

- Central banks could revise inflation and interest rate outlooks.

3. Global Supply Chains Will Be Affected

- Increased shipping times (10–14 days longer via Cape of Good Hope).

- Higher freight and insurance costs, especially for oil shipments.

4. Higher Costs for Manufacturing Countries

- Countries like India, China, Japan, and South Korea will face higher energy and manufacturing costs.

- These costs will be passed on to consumers, increasing global inflation.

IMPACT ON INDIA

India’s Oil Dependency

- India imports ~88% of its crude oil needs.

- India consumes ~5.5 million barrels per day (bpd).

- 1.5 to 2 million bpd comes through the Strait of Hormuz.

- ~4 million bpd comes via other global routes.

BREAKDOWN OF IMPORT ROUTES (KPLER ESTIMATES)

| Route | Share of Imports | Main Source Countries |

| Strait of Hormuz | ~40% | Iraq, Saudi Arabia, UAE, Kuwait |

| Suez Canal | ~33% | Russia |

| Cape of Good Hope | ~17% | West Africa, Americas |

| Other Routes | ~10% | Southeast Asia, Far East |

KEY RISKS FOR INDIA

| Risk Category | Specific Effects |

| Oil Price Hike | Increased import bill, inflation, fiscal burden |

| Freight & Insurance | Longer routes → Higher transport costs and delivery delays |

| Currency Depreciation | Pressure on rupee → Wider current account deficit |

| Trade Disruption | Container shortages may affect exports and imports (esp. Europe-Asia corridor) |

WHAT DID INDIA’S OIL MINISTER SAY?

Minister Hardeep Singh Puri (June 23, 2025):

- “We have diversified our oil sources in the past few years.

- A large volume of our supplies no longer come through the Strait of Hormuz.

- Our Oil Marketing Companies have supplies for several weeks and continue to receive energy through several routes.”

The Minister also:

- Held a high-level security review with officials from the Navy, Coast Guard, ONGC, and Defence Ministry.

- Reaffirmed the government’s commitment to ensure uninterrupted fuel supply.

HOW COULD IRAN BLOCK THE STRAIT?

| Method | Description |

| Naval Mines | Laid using submarines or small attack boats |

| IRGC Fast Boats | Swarm attacks using speedboats with anti-ship missiles |

| Submarine Warfare | Attacks on commercial or military vessels using submarines |

| Semi-submersibles | Hard-to-detect vessels targeting oil tankers |

Historical Reference: In the 1980s, during the Iran–Iraq war, similar tactics led to the “Tanker War” where both nations attacked commercial oil shipments.

U.S. Response:

- Fifth Fleet is stationed in Bahrain.

- Past success: Operation Earnest Will (1987–88) safely escorted Kuwaiti oil tankers.

WILL IRAN ACTUALLY CROSS THE STRAIT?

| Factor | Explanation |

| Loss of Own Oil Revenue | Iran earns ~$67 billion from oil exports (FY 2024–25) |

| China is a Key Buyer | China buys ~90% of Iranian oil – would be negatively impacted |

| Diplomatic Isolation | Gulf countries (Saudi Arabia, UAE) may turn hostile |

| U.S. and Allied Response | Risk of direct military conflict |

| Gulf Normalization Setback | Iran’s recent regional diplomacy could collapse |

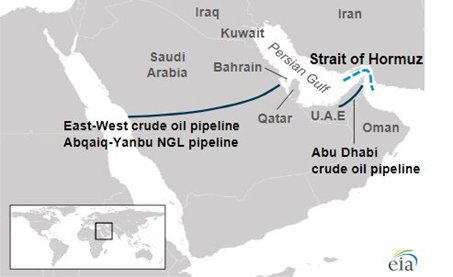

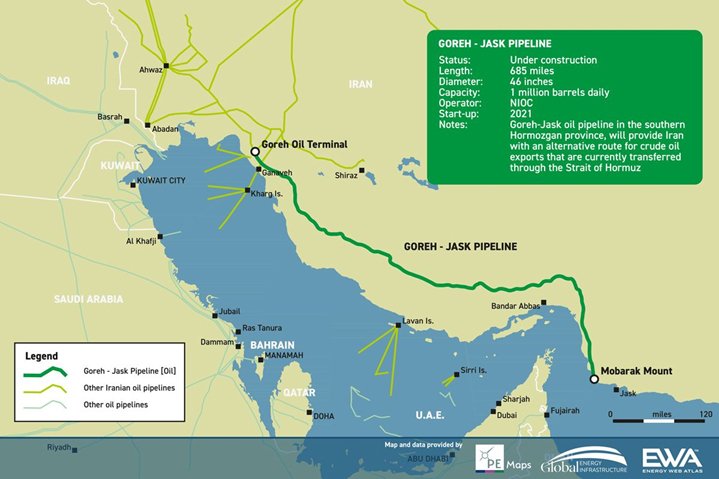

ARE THERE ANY EXPORT ROUTES?

| Country | Pipeline Name | Capacity (approx.) |

| Saudi Arabia | East–West Pipeline (Petroline) | 5 million barrels/day |

| UAE | Habshan–Fujairah Pipeline | 1.5 million barrels/day |

| Iran | Goreh–Jask Pipeline | ~350,000 barrels/day |

Limitation: These can handle ~3.5 million bpd, while the Strait handles ~20 million bpd.

Note: Connect with Vajirao & Reddy Institute to keep yourself updated with latest UPSC Current Affairs in English.

Note: We upload Current Affairs Except Sunday.