New T+1 settlement cycle comes into effect today : What does it mean, how will investors be impacted?

Context- After China, India will become the second country in the world to start the ‘trade-plus-one’ (T+1) settlement cycle in top listed securities today (January 27), bringing operational efficiency, faster fund remittances, share delivery, and ease for stock market participants.

What’s the T+1 settlement plan?

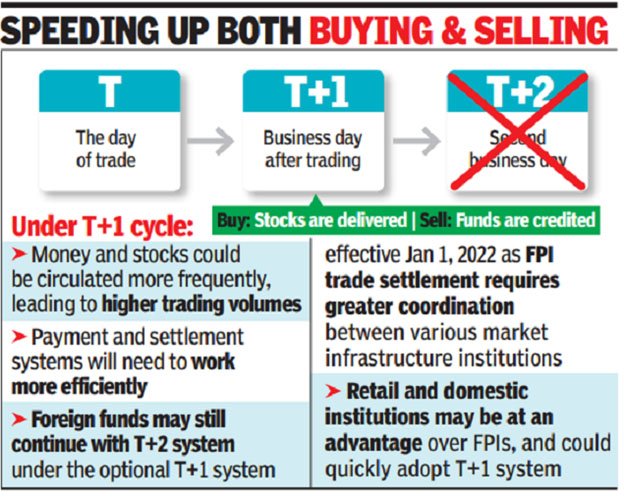

- The T+1 settlement cycle means that trade-related settlements must be done within a day, or 24 hours, of the completion of a transaction. For example, under T+1, if a customer bought shares on Wednesday, they would be credited to the customer’s demat account on Thursday. This is different from T+2, where they will be settled on Friday.

- As many as 256 large-cap and top mid-cap stocks, including Nifty and Sensex stocks, will come under the T+1 settlement from Friday.

- Until 2001, stock markets had a weekly settlement system. The markets then moved to a rolling settlement system of T+3, and then to T+2 in 2003.

- T+1 is being implemented despite opposition from foreign investors. The United States, United Kingdom and Eurozone markets are yet to move to the T+1 system.

And what are the benefits of T+1?

- In the T+1 format, if an investor sells a share, she will get the money within a day, and the buyer will get the shares in her demat account also within a day.

- This will also help investors in reducing the overall capital requirements with the margins getting released on T+1 day, and in getting the funds in the bank account within 24 hours of the sale of shares. The shift will boost operational efficiency as the rolling of funds and stocks will be faster

Could it also make markets safer?

A shortened settlement cycle also reduces the number of outstanding unsettled trades at any point of time, and thus decreases the unsettled exposure to Clearing Corporation by 50 per cent. The narrower the settlement cycle, the narrower the time window for a counterparty insolvency/ bankruptcy to impact the settlement of a trade.

Why are foreign investors opposed?

Foreign investors were against SEBI’s T+1 proposal, and had written to the regulator and the Finance Ministry about the operational issues faced by them, as they operate from different geographies. Among the issues raised by them were time zone differences, information flow processes, and foreign exchange problems.

Source- Indian Express

NEWS- New T+1 settlement cycle comes into effect today : What does it mean, how will investors be impacted?

Syllabus- Prelims; Current Affairs