QR CODE BASED COIN VENDING MACHINE

WHY IN NEWS?

- Recently, RBI in its monetary policy announced QR-code based coin vending machine.

WHAT ARE QR-CODE BASED COIN VENDING MACHINE?

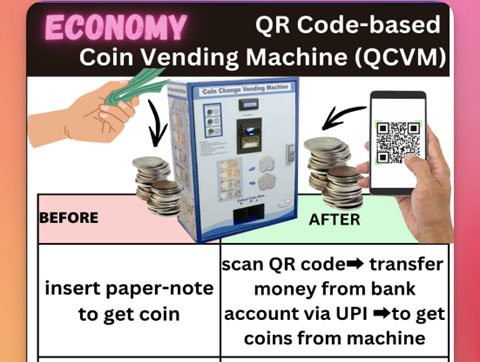

- QR code-based coin vending machine or QCVM is intended to dispense coins similar to the manner in which currency notes can be withdrawn from ATMs.

- Coins can be withdrawn using the UPI QR code in designated vending machines.

- Customers will also have the option to withdraw coins in the required quantity and denominations in QCVMs.

WHAT DENOMINATIONS OF COINS ARE LIKELY TO BE DISTRIBUTED THROUGH THIS MODE?

- Coins of denomination of ₹1 – ₹20 are popularly in circulation now and these will be made available in QCVM.

- These vending machines are intended to be installed at public places such as railway stations, shopping malls, marketplaces to enhance ease and accessibility

HOW ARE COINS DISPENSED CURRENTLY?

- Presently, a person will have to approach his/her bank branch to withdraw coins.

- But if someone wants ₹5 coins for ₹3,000, (s)he will have to walk into her/his bank branch and tender the currency note in exchange of coins.

- They are also distributed at Reserve Bank of India’s regional offices.

DOES IT MAKE EASIER FOR USERS AND BANKS?

- As the interface here is UPI which is linked to the bank account of the person, the value of coins withdrawn is directly debited from the bank account.

- Thus it removes the requirement of tending notes in exchange of coins which saves time for the bank branches and the customer.

- Banks will have to keep replenishing these vending machines similar to the manner in which ATMs are stocked.

- This could imply additional costs for banks since this is done through third party agents.

WILL ALL BANKS PARTICIPATE IN THIS?

- RBI plans to launch the product in 19 locations across 12 cities.

- Since the implementation would begin through a pilot launch, only select banks may be involved in the initial stages.

- For now, the launch date or the bank selected for this process hasn’t been revealed and we’ll have to wait for a detailed circular regarding these aspects.

HOW QCVM WILL BE SUCCESSFUL?

- For people, coins find use in public transport including autorickshaws, especially if you are a resident of Mumbai for instance.

- With cash sales still being an important component at petty shops and kirana stores, where coins tend to be in short supply, such vendors could also benefit from QCVM.

- QCVM can also prove successful in case of dealing with street vendors.

ISN’T IT CONTRADICTORY TO GOVERNMENT’S CASHLESS VISION?

- The intention seems to be to enhance the last mile availability of cash across segments including the mass market.

- However, with UPI available on feature phones and the intent of the government remaining steady on increasing the popularity and reach of digital payments, QCVM could be counterproductive.

- The average cost of minting a coin is ₹1.11. If we add another layer for setting up and distributing coins through vending machines, the proposition appears unattractive from a cost perspective.

- Also, e-Rupee’s retail launched in December 2022 is intended to reduce the minting/printing cost of currency and gradually replace physical currencies with digital currencies, QCVM seems to be defying that purpose as well.

SOURCE : LIVEMINT

SYLLABUS : MAINS, GS 3 INDIAN ECONOMY