SOUTH ASIA’S PATH TO RESILIENT GROWTH

WHY IN NEWS ?

- Recently International Monetary Fund(IMF) has opined and warned that, South Asia should now have a relook at regional trade across Asia. As also global trade would slow down from 5.4% in 2022 to 2.4% in 2023.

SOUTH ASIA- AN ECONOMIC HUB

- There exists strong base for South Asia in trading more with dynamic East Asia as the total merchandise trade between South Asia and East Asia grew at about 10% annually between 1990 and 2018 to $332 billion in 2018.

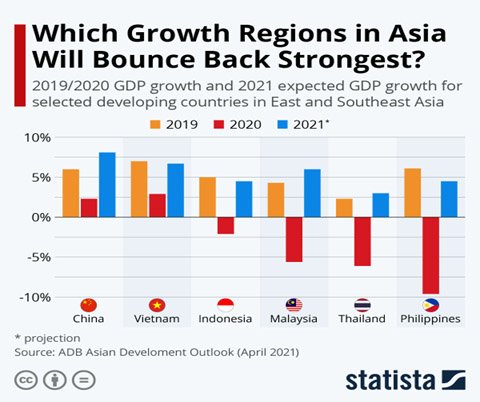

- Many South-East Asian countries such as Vietnam, Indonesia and Malaysia has shown remarkable rise in economic figures.

- Since the 1990s, South Asia East Asia trade has gathered an economic pace.

- Seeing this opportunity many nations such as India has also formulated trade policies re-aligning towards East Asia through its ‘Look East’ and ‘Act East’ policies.

- China also entered by offshoring global supply chains to Asia.

- Free trade agreements (FTAs) linking economies in South Asia with East Asia may rise to 30 by 2030.

- Regional trade in Asia is also recovering after the COVID-19 pandemic.

- Thus, it has opened various opportunities for South Asia to participate in global value chains and services trade.

HOW SOUTH ASIA CAN CAPITALISE ON SUCH OPPORTUNITIES ?

- FREE TRADE AGREEMENTS (FTAs) : South Asia should pursue comprehensive FTAs that will eventually lead to the Regional Comprehensive Economic Partnership (RCEP) to provide for a regional rules- based trade to insure against rising protectionism.

- Although South Asia is a latecomer and comparatively new to FTAs when compared to East Asia, but it has made a start with the Japan- India FTA, the SriLanka- Singapore FTA and the Pakistan- Indonesia FTA.

- REGIONAL TRADE INTEGRATION: Regional trade integration across Asia can be encouraged by gradually reducing barriers to goods and services trade.

- South Asia’s trade opening also should be calibrated with tax reforms as trade taxes account for much of government revenue in some countries.

- Adjustment of financing to losing sectors to reallocate factors of production and retraining of workers is also essential to promote gains from trade and reduce income inequality at the same time.

- SPECIAL ECONOMIC ZONES: improving the performance of SEZs and to invest in services SEZs to facilitate industrial clustering and exports.

- South Asia has over 600 SEZs in operation, in Kochi (India), Gwadar (Pakistan), Mirsarai (Bangladesh) and Hambantota (Sri Lanka).

- But these SEZs have a problem of variable record in terms of exports and jobs and fostering domestic linkages.

- As competitive fiscal incentives only works on the margin in the locational decisions of multinationals, and thus long tax holidays deprive economies of vital tax revenue.

- Improving the conditions of SEZ’s processes and outcomes in South Asia requires:-

- Ensuring macroeconomic.

- Political stability

- Adopting good practice regulatory policies towards investors

- Providing reliable electricity

- 5G broadband cellular technology

- Upgradation of worker skills

- LEVERAGING MULTILATERAL FORUMS: A reinvented trade focused Bay of Bengal Initiative for Multi Sectoral Technical and Economic Cooperation (BIMSTEC) can facilitate stronger trade ties and support the interests of smaller members.

- Reinventing BIMSTEC requires better resourcing its Secretariat, concluding the long running BIMSTEC FTA, building trade capacity in smaller economies, and introducing dialogue partner status to encourage open regionalism in Asia.

- OTHER ISSUES: South Asian economies needs to improve tariff preference use by better preparing business in navigating the complex rules of origin in FTAs.

- It should also focus on issues relevant to global supply chains in future FTAs.

ROAD AHEAD FOR INDIA

- As India is South Asia’s largest economy and its G-20 presidency can be a good platform to initiate these changes.

- As India has opted out of the RCEP talks in November 2019, the door is still open for it to join the agreement.

- India has recently concluded FTAs with the United Arab Emirates and Australia in 2022.

- India can make use of confidence gained from these , as it can help prepare for future RCEP membership by undertaking structural reforms to boost business competitiveness in supply chains and foster greater regulatory coherence with East Asia.

- By India joining RCEP, the rest of South Asian countries may be incentivised to join out of a fear of being left out and suffering from trade diversion effects.

WAY FORWARD

- As broad South Asia East Asia trade may be desirable, the advent of increasingly complex geopolitics might rule this out for some time.

- A narrower geographical coverage between South Asia and Southeast Asia may be a building block for eventual trade integration across Asia.

- To mitigate a backlash against regionalisation, the larger economies should facilitate gains from trade to the smaller economies.

SOURCE : THE HINDU

SYLLABUS : MAINS, GS-3 , Factors affecting Indian Economy.