UNION BUDGET 2024-25

WHY IN NEWS ?

- Recently, Finance Minister Nirmala Sitharaman presented the Union Budge for the next financial year (2024-25).

MAJOR PROJECTIONS OF THE BUDGET:

- India’s real GDP is projected to grow at 7.3% in FY 2024-25.

- The budget has projected a nominal gross domestic product (GDP) of ₹327.7 trillion for 2024-25, which is a jump of 10.5% from ₹296.6 trillion in 2023-24.

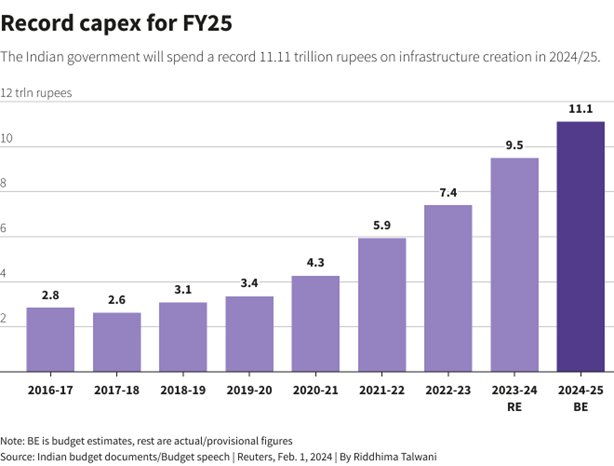

- The Capital Expenditure outlay for the next year is being increased by 11.1% to Rs11,11,111 crore.

- Fiscal deficit in 2024-25 is estimated to be 5.1% of gdp, lower than the revised estimate of 5.8% of GDP in 2023-24.

- The Revenue deficit in 2024-25 is targeted at 2% of GDP, which is also lower than the revised estimate of 2.8% in 2023.

- The receipts (other than borrowings) in 2024-25 are estimated to be Rs 30,80,274 crore, about 12% higher than the revised estimate of 2023-24.

- Tax revenue which are major part of the receipts is also expected to increase by 12%, over the revised estimate for 2023-24.

POLICIES IN BUDGET:

- Three major economic railway corridor programs will be implemented.

-

- energy, mineral and cement corridors

- port connectivity corridors

- high traffic density corridors.

- An additional 2 crore houses will be built over the next 5 years under Pradhan Mantri Awas Yojana (Grameen).

- There is also announcement of a new scheme to help sections of the middle-class living in rented houses, slums, and unauthorised colonies, to buy or build their own houses.

- Vaccination programme to prevent the cervical cancer will be encouraged for girls between nine and 14 years of age.

- A new platform, U-WIN, will be rolled out for managing immunisation across the country.

- The Healthcare cover under Ayushman Bharat scheme will be extended to all ASHA, Anganwadi workers and helpers.

- Blending of compressed biogas in CNG and PNG will be mandated in a phased manner to achieve net-zero by 2070.

- The Coal gasification and liquefaction capacity of 100 metric tonnes will be installed by 2030.

- A corpus of one lakh crore rupees will be set up to encourage the private sector to scale up research and innovation. This corpus will provide long-term loans at very low or no interest rates.

TAXATION ESTIMATES:

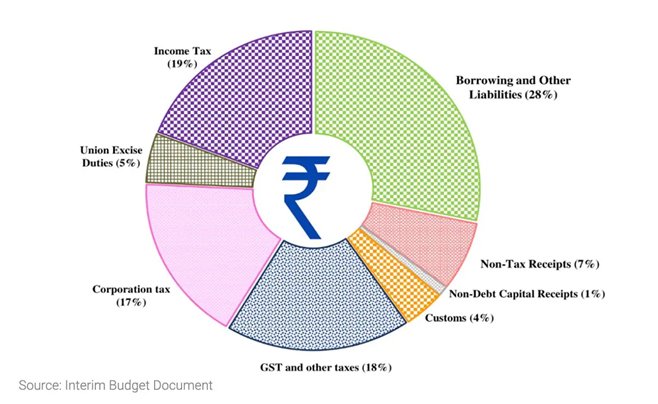

- The personal income taxes are expected to be at ₹11.56 trillion, or 3.5% of the GDP, against corporate taxes estimates of ₹10.43 trillion or 3.2%.

NOTE: Where does rupee come from:

- The corporate tax estimates are lower as they continue to benefit from the cut in the rate which happened in 2019.

- In 2024-25, the government expects to collect a total goods and services tax (GST) of ₹10.68 trillion or 3.3% of the GDP, which is a slight jump from 3.2% in 2023-24.

- This includes central GST, integrated GST, and GST compensation cess. This

BUDGETARY ESTIMATES:

- It is a financial projection that predicts the costs and expenses related to a project or activity.

- The government is estimated to spend Rs 47,65,768 crore in 2024-25. This is an increase of 6% over the revised estimates of 2023-24.

- Revenue expenditure is estimated to grow at 3.2% and capital expenditure at 16.9%.

NOTE: Where does rupee goes to:

- Government receipts (excluding borrowings) are estimated to be Rs 30,80,274 crore, 11.8% higher than the revised estimates of 2023-24.

SCHEMES ANNOUNCED IN BUDGET:

LAKHPATI DIDI SCHEME:

- Around 83 lakh SHGs (self-help groups) with 9 crore women are transforming the rural socio-economic landscape with empowerment and self-reliance.

- The Scheme aimed to empower two crore women in villages.

- There is a provision of a financial injection of ₹1 lakh per household for one crore beneficiaries.

- This initiative is poised to significantly uplift the economic status of rural women.

PM AWAS YOJANA:

- To meet the requirement arising from the increase in the number of families, two crore more houses will be taken up in the next five years.

- The intensified focus on PMAY is expected to trigger increased investments and heightened activity in the construction sector, which will also have multiplier effects on Housing Finance, Cement, Steel, and Paints industries, reflecting a significant positive impact across various sectors.

WAY AHEAD:

- The government envisions a dream of ‘Viksit Bharat’ by 2047 with a focus on prosperity, modern infrastructure, and opportunities for all citizens.

- The trinity of demography, democracy, and diversity, backed by ‘Sabka Prayas’ is seen as the key to fulfilling aspirations.