UNIFIED PENSION SCHEME

The Union Cabinet, chaired by the Prime Minister Shri Narendra Modi, approved the Unified Pension Scheme (UPS).

Cabinet Decision:

- Approval and Rollout: The UPS was approved by the Union Cabinet and is set to be implemented from April 1, 2025.

- State Adoption: States have the option to adopt the UPS architecture, which contrasts with the OPS’s unfunded liabilities and absence of employee contributions.

The Union Cabinet’s recent approval of the Unified Pension Scheme (UPS) represents a significant shift in India’s pension policy for government employees. UPS aims to address the limitations of the previous pension systems—the Old Pension Scheme (OPS) and the National Pension System (NPS).

FEATURES

In a major benefit for 23 lakh central government employees, the Modi government has introduced a new Unified Pension Scheme (UPS), that assures a pension of 50% of the basic salary for those who joined the service after January 1, 2004, under the National Pension System (NPS).

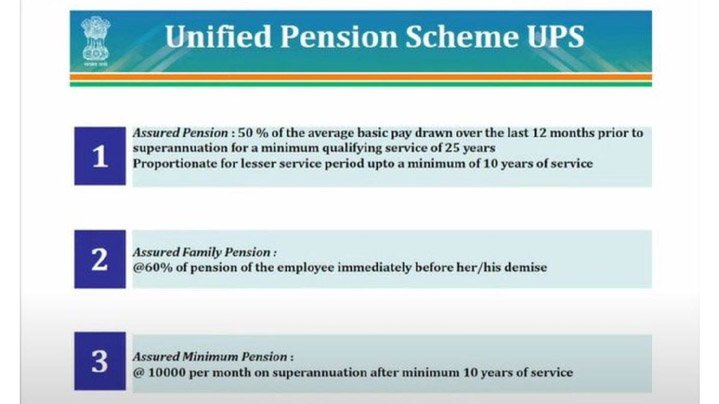

Features:

- Pension Amount: Guarantees 50% of the average basic pay over the last 12 months of service, with a proportionate pension for those with less than 25 years of service. A minimum pension of ₹10,000 per month is guaranteed for those with at least 10 years of service.

- Family Pension: In the case of death, the family receives 60% of the retiree’s pension amount, ensuring continued support.

- Lump-Sum Payment: Retirees receive a lump-sum amount calculated as 1/10th of their last drawn monthly pay (including DA) for every 6 months of service completed.

- Inflation Protection: The UPS includes provisions for adjusting pensions based on the All India Consumer Price Index for Industrial Workers (AICPI-IW), similar to the DA adjustments in OPS.

(All India Consumer Price Index for Industrial Workers (AICPI-IW): This is a measure of inflation that specifically tracks the prices of goods and services consumed by industrial workers. It’s used to calculate the Dearness Allowance (DA) for government

employees, which is added to their basic salary to offset the effects of inflation.

- Contributory Nature: Employees contribute 10% of their salary, while the government contributes 18.5%. Contributions will be periodically adjusted based on actuarial assessments.

OLD PENSION SCHEME

Features:

- Pension Amount: Guarantees 50% of the last drawn basic pay as a pension. This provides a stable and predictable income after retirement.

- Family Pension: In the event of the retiree’s death, their family continues to receive the same pension amount as a family pension.

- Gratuity: Employees are entitled to a gratuity of up to ₹20 lakh upon retirement.

- Employee Contributions: No salary deductions for pension contributions during employment.

- Dearness Allowance (DA): Pension is adjusted periodically based on DA, which compensates for inflation.

- Financial Aspects:

- Funding: The pension is financed directly from the government’s treasury, making it an unfunded scheme.

- Challenges: As life expectancy increased, the OPS became financially unsustainable, leading to rising pension liabilities and a strain on government finances by 2020-21.

NATIONAL PENSION SCHEME

Features:

- Contribution: Employees contribute 10% of their basic salary plus Dearness Allowance (DA), with a matching government contribution. This increased to 14% in 2019.

- Pension Amount: Does not guarantee a fixed pension. Instead, pension depends on the accumulated corpus and investment returns. Upon retirement, individuals can withdraw 60% of their corpus tax-free, with the remaining 40% used to purchase an annuity for monthly pension payments, generally around 35% of their final salary.

- Investment Options: Offers various investment schemes managed by pension fund managers, allowing employees to choose between different risk profiles.

- Tax Benefits: Contributions are tax-deductible under Section 80 CCD of the Income Tax Act, but withdrawals and pension payouts are subject to taxation.

CRITICISMS

- No DA Adjustments: Unlike OPS, the NPS does not provide automatic DA increments for inflation, resulting in potentially unpredictable pension amounts.

- Market-Linked: The scheme’s reliance on market-linked investments has led to dissatisfaction due to the variability in pension returns.

- Mandatory Contributions: The scheme’s mandatory employee contributions and tax implications have been points of contention.

UPS V/S OPS V/S NPS

Advantages of UPS Over OPS:

- Guaranteed Pension with Inflation Protection: Like OPS, the UPS offers a guaranteed pension and family pension, but it also incorporates inflation adjustments through AICPI-IW, addressing the inflation protection that was a key feature of OPS.

- Minimum Pension Guarantee: The UPS introduces a minimum pension of ₹10,000 per month for those with at least 10 years of service, which provides a financial safety net not guaranteed under OPS.

- Contributory Aspect: While OPS requires no employee contributions, the UPS’s contributory nature (with fixed employee and government contributions) aims to balance financial sustainability with employee benefits.

Advantages of UPS Over NPS:

- Fixed Pension Amount: Unlike NPS, which does not guarantee a fixed pension amount, the UPS ensures a predictable pension based on the last drawn salary, offering more financial security.

- Inflation Indexation: UPS includes inflation protection similar to OPS, mitigating the issue of pension volatility seen in NPS.

- Lump-Sum Payment: The additional lump-sum payment upon retirement under UPS provides extra financial support, enhancing the overall retirement package.

REACTIONS FOR THE SCHEME

- Prime Minister’s Statement: Prime Minister Narendra Modi highlighted the UPS’s role in providing financial security and dignity to government employees, reflecting a commitment to their well-being.

- Mixed Reactions: Reactions among government employee representatives were varied. The Central Secretariat Service Forum welcomed the UPS but continued to demand the OPS. The Joint Consultative Mechanism (JCM) showed cautious optimism, while some unions expressed dissatisfaction with the contributory nature of the UPS.

- Ministerial Comments: Information and Broadcasting Minister Ashwini Vaishnaw noted that Congress-ruled States had yet to fully implement OPS and praised the UPS for its consultative development and inter-generational equity.

CONCLUSION

The Unified Pension Scheme aims to blend the stability of the Old Pension Scheme with some modern features of the National Pension System. By guaranteeing a fixed pension amount, including inflation adjustments, and providing additional lump-sum payments, the UPS seeks to offer a more predictable and secure retirement plan. It responds to the criticisms of the NPS while retaining desirable aspects of the OPS, aiming to address the shortcomings and offer a balanced solution for government employees.

Note: Connect with Vajirao & Reddy Institute to keep yourself updated with latest UPSC Current Affairs in English.

Note: We upload Current Affairs Except Sunday.